Kategorie: Kurse & Leistungen

Erste Hilfe Kurs für Führerschein / BG

Erste Hilfe Kurs für Führerschein / BG Als zugelassene Ausbildungsstelle: […]

Zum Kursangebot

Evakuierungshelfer

Der Arbeitgeber ist verpflichtet, für die Aufgaben im Rahmen der […]

Mehr erfahren

Erste Hilfe Ausbilder Lehrgang pädagogischer Teil 24 UE

Erste Hilfe Ausbilder Lehrgang pädagogischer Teil 24 UE Erste Hilfe […]

Zum Kursangebot

Erste Hilfe Ausbilder Fortbildung 16 UE (E-Learning 8 UE / Präsens 8 UE) 2023

Erste Hilfe Ausbilder Fortbildung 16 UE (E-Learning 8 UE / […]

Zum Kursangebot

Erste Hilfe Ausbilder Lehrgang Fachdidaktik Teil 32 UE / Lehrprobe

Erste Hilfe Ausbilder Lehrgang Fachdidaktik Teil 32 UE / Lehrprobe […]

Zum Kursangebot

American Heart Association ACLS Provider Kurs

American Heart Association ACLS Provider Kurs Kursbeschreibung: Der AHA ACLS […]

Zum Kursangebot

American Heart Association BLS Provider Kurs

American Heart Association BLS Provider Kurs Basisreanimation für medizinisches Fachpersonal […]

Zum Kursangebot

Lehrprogrammbezogenen Einweisung für Betriebssanitäter Ausbilder

Lehrprogrammbezogenen Einweisung für Betriebssanitäter Ausbilder – gem. Berufsgenossenschaft (BG) Ausbilder […]

Zum Kursangebot

Jährliche Unterweisung §12 Arbeitsschutzgesetz

Jährliche Unterweisung §12 Arbeitsschutzgesetz Weitere Informationen

Zum Kursangebot

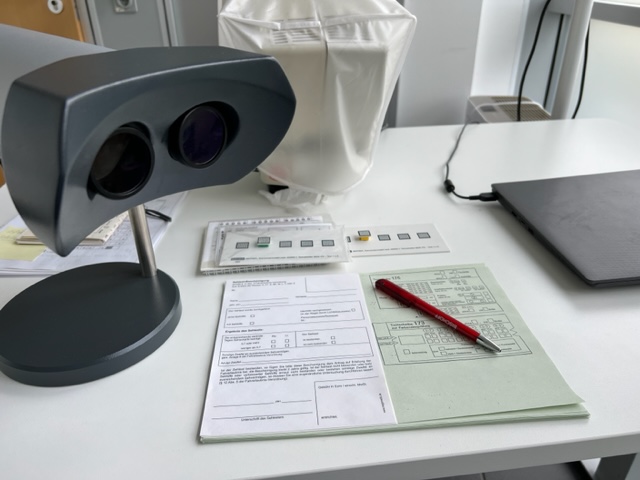

Sehtester Lehrgang (E-Learning)

Sehtester Lehrgang (E-Learning) Dieser Kurs wird in Form eines Zoom-Meeting […]

Zum Kursangebot

American Heart Association PALS Instructoren Kurs

American Heart Association PALS Instructoren Kurs In einer AHA-Kursleiterschulung werden […]

Zum Kursangebot

American Heart Association PALS Provider Kurs

American Heart Association PALS Provider Kurs Jetzt mit PALS Provider […]

Zum Kursangebot

American Heart Association PEARS Provider Kurs

American Heart Association PEARS Kurs Jetzt mit PALS Provider Buch […]

Zum Kursangebot

American Heart Association ACLS Instructoren Kurs

American Heart Association ACLS Instructoren Kurs In einer AHA-Kursleiterschulung werden […]

Zum Kursangebot

American Heart Association BLS Instruktoren Kurs

American Heart Association BLS Instruktoren Kurs In einer AHA-Kursleiterschulung werden […]

Zum Kursangebot

Notfalltraining

Ein Notfalltraining für Senioren- und Pflegeeinrichtungen vor Ort Weitere Informationen

Zum Kursangebot

Betriebssanitäter Ausbilder Fortbildung - gem. Berufsgenossenschaft (BG)

Betriebssanitäter Ausbilder Fortbildung – gem. Berufsgenossenschaft (BG) Ausbilder bzw. Ausbilderin […]

Zum Kursangebot

Lehrprogrammbezogenen Einweisung für Erste Hilfe Ausbilder Kinder und Betreuungseinrichtungen

Lehrprogrammbezogenen Einweisung für Erste Hilfe Ausbilder Kinder und Betreuungseinrichtungen gem. […]

Zum Kursangebot

Betriebssanitäter Grundkurs

Betriebssanitäter Grundkurs Grundsätzliches Notwendig ist ein Betriebssanitäter generell, wenn in […]

Zum Kursangebot

Betriebssanitäter Aufbaukurs

Betriebssanitäter Aufbaukurs Die Teilnehmer machen sich auf der Grundlage der […]

Zum Kursangebot

Betriebssanitäter Fortbildung

Betriebssanitäter Fortbildung Die Lernpartner werden auf der Grundlage der im […]

Zum KursangebotEH-Ausbildung für Personal in Bildungs- und Betreuungseinrichtungen

EH-Ausbildung für Personal in Bildungs- und Betreuungseinrichtungen Für Erzieher, Lehrer […]

Zum Kursangebot

Erste Hilfe Kurs für gehörlose nach den BG Vorgaben / FeV §68

Erste Hilfe Kurs für gehörlose nach den BG Vorgaben / […]

Zum KursangebotEH-Ausbildung für gehörlose für Personal in Bildungs- und Betreuungseinrichtungen

EH-Ausbildung für gehörlose für Personal in Bildungs- und Betreuungseinrichtungen Für […]

Zum Kursangebot